Explain the Difference Between a Premium and a Deductible

Choosing a higher deductible will lower your premium payments but keep in mind that youll pay more out of pocket when it comes time to submit a claim. A deductible is the amount you pay for coverage services before your health plan kicks in.

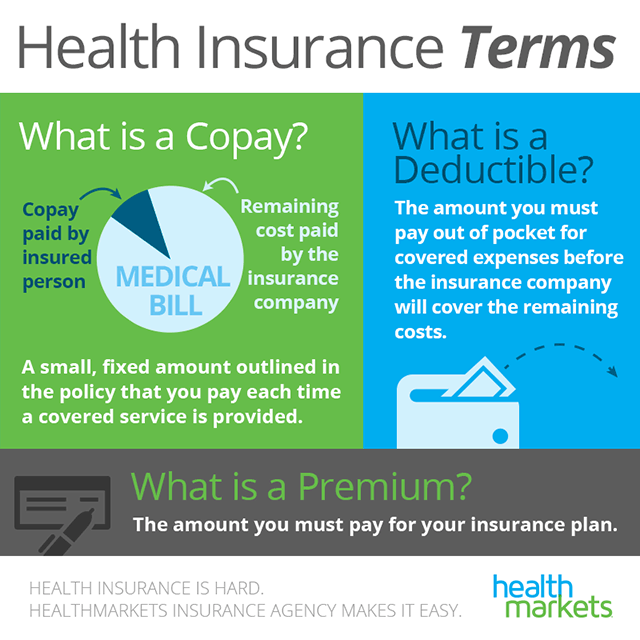

What Is A Deductible Learn More About Your Health Insurance Options Healthmarkets

You have to pay a fixed amount towards your treatment plan but your insurance premium will only start once you have paid your deductibles If and when the plan kicks in youll have to pay the fixed copayment amount every time you raise the claim while the outstanding amount will be paid by the insurance provider.

. The insurer and insured in which the insured. Explain the difference between a premium and a deductible. For example If you are confident that youre in control of your business risks you may be willing to pay a higher deductible since you think you will have few or no claims during the policy period.

Plans that have lower monthly premiums tend to have higher deductibles. The deductible is what you pay if you file a claim before your insurance company starts to pick up the tab. A lot of people confuse these two.

The higher the deductible the lower the premium and vice versa. The average deductible for an individual in 2020 was 4364 but deductibles can range from 0 to over 8000. We hope you now understand the difference between deductibles premiums co-pays co-insurance and out-of-pocket maximum.

For the other 91 of. 3- What can you say about the type of individual preferences if the risk premium is zero. The deductible is the amount of money youd have to pay out of pocket before the insurance company will pay for services.

If you are about to start your car wash franchise business you should know the difference between a franchise deductible and ordinary deductible. It is essential to understand it because without it a useful health insurance comparison cannot be made. Pepperdine reported net sales of 8500 million net income of 126 million and average accounts receivable net of 680 million.

The amount you pay to the Insurance Company for your coverage. 2-What is the difference between. The amount the insurance company pays after you meet the deductible will depend on your coinsurance percentage.

When you are thinking of purchasing a health insurance policy pay attention to these important terms as they will decide how much you will have to pay for the coverage and what benefits you will get. Difference between Franchise Deductible and Ordinary Deductible. Your deductible starts over at the beginning of each year and youll have to meet your annual deductible again before insurance will begin to pay.

Deductibles vary but most insurers require a minimum deductible. There is an inverse relationship between the size of the deductible and the amount of the premium. Premiums and deductibles are terms that are closely related to one another in that they both are insurance terminology.

Derrick owns a farm in eastern north carolina. For example if you have a 500 deductible on your auto insurance and need 1500 of repairs you pay 500and your insurer pays the remaining 1000. Health plan premium health plan deductible out-of-pocket maximum and co-insurance.

Essentially your premium gets you covered and your deductible comes into play when you have a loss and need to submit a claim. A premium is like your monthly car payment. Average Car Insurance Deductibles.

Many people choose a 500 car. The premium is the amount you pay for having the coverage. Your insurance premium and deductible have an inverse relationship.

In general the higher your monthly premium is the lower your deductible is. You must make regular payments to keep your car just as you must pay your premium to keep your health care plan active. The amount of money you pay when you visit a doctor.

The difference between copays and deductibles is generally the amount you have to pay and how often you have to pay it. 1- Explain the concept of risk premium. In addition to your monthly premium your deductible is the amount of money you have to pay out-of-pocket for covered medical expenses before your insurance company starts helping with costs.

The premium is what you pay to buy and keep the coverage. A deductible on the other hand is the set amount that you must pay each year in addition to your premium towards a loss or liability before your insurance company will start paying on your behalf. Economics questions and answers.

A deductible is what you pay first for your health care. Plans that charge higher monthly premiums have lower co-payments and lower deductibles. 1- Explain the concept of risk premium.

2-What is the difference between premium and deductible. A hurricane hit the area and destroyed a farm building and some. A recent survey by the UnitedHealthcare Group found that only 9 of Americans have an understanding of four of the most basic health insurance terms.

Then youll pay a portion of your health care costs as defined by your policy until you reach your out-of-pocket maximum. This is called the premium. The amount you have to pay before the Insurance Company begins to pay for services before your benefits begin to pay.

Difference between Coinsurance Deductible Out-Of-Pocket Limit Copayment and Premium Health Insurance like any other type of insurance has its own terminology. Premium vs Deductible An insurance policy is a contract that is signed between two parties. Answer 1 of 5.

As one increases the other decreases so a policy with a lower monthly premium will typically have a higher deductible and a policy with a lower deductible will typically have a higher premium. The premium is the fee paid by the. Insurance companies give drivers different deductible amounts to choose from and most options fall between 100 and 2000.

For each policy year youll pay the full cost of doctors and treatments until your total spending reaches the deductible amount. Deductibles are generally much larger than copays but you only have to pay them once a year unless youre on Medicare in which case the deductible applies to each benefit period instead of following the calendar year. In general plans that charge lower monthly premiums have higher co-payments and higher deductibles.

Read on and have a better glimpse of the difference between these two franchise terms. To illustrate a comparison with a car insurance policy you pay a monthly or yearly bill for the coverage.

Deductible Vs Premium Choose Between Low And High Deductible Plans

Difference Between Coinsurance And Deductible Difference Between

No comments for "Explain the Difference Between a Premium and a Deductible"

Post a Comment